Major Financial Data

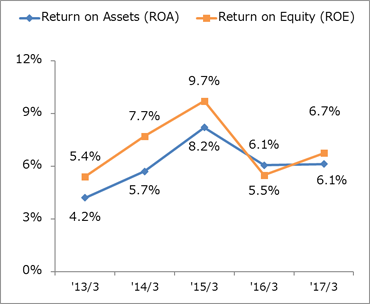

ROA, ROE

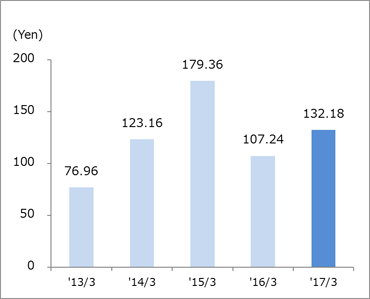

Earnings Per Share

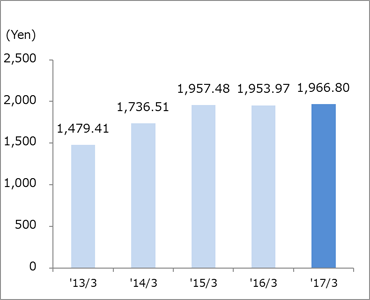

Book-value per Share

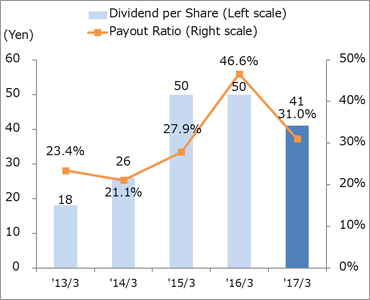

Dividend per Share, Payout Ratio

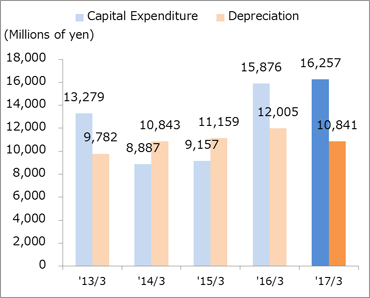

Capital Expenditure, Depreciation

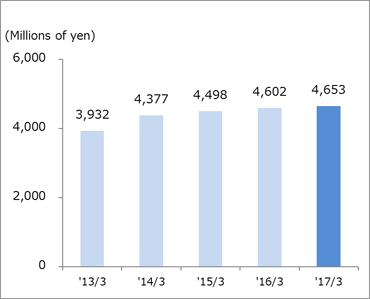

R&D Expenses

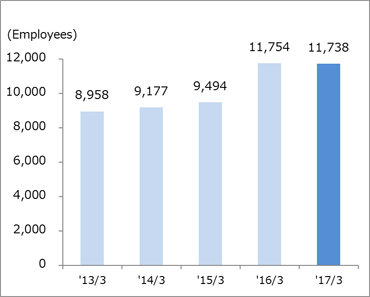

Number of Employees at End of Periods

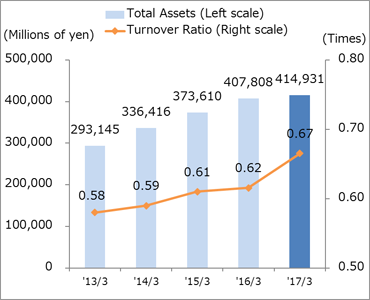

Total Assets, Turnover Ratio

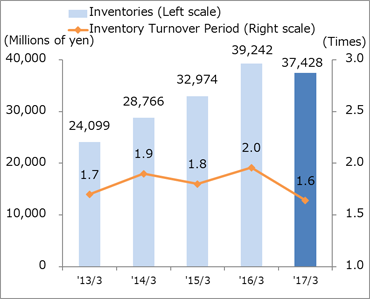

Inventory, Inventory Turnover Period (Months)

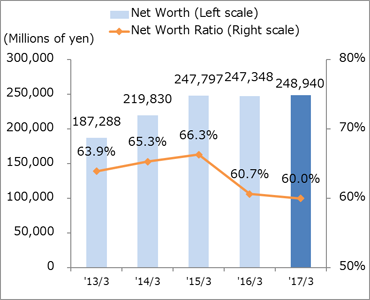

Net Worth Ratio

Millions of yen,Yen,Employees

| '13/3 | '14/3 | '15/3 | '16/3 | '17/3 | |

|---|---|---|---|---|---|

| Return on Assets (ROA) | 4.2% | 5.7% | 8.2% | 6.1% | 6.1% |

| Return on Equity (ROE) | 5.4% | 7.7% | 9.7% | 5.5% | 6.7% |

| Earnings per Share | 76.96 | 123.16 | 179.36 | 107.24 | 132.18 |

| Book-value per Share | 1,479.41 | 1,736.51 | 1,957.48 | 1,953.97 | 1,966.80 |

| Dividend per Share | 18 | 26 | 50 | 50 | 41 |

| Payout Ratio | 23.4% | 21.1% | 27.9% | 46.6% | 31.0% |

| Capital Expenditure* | 13,279 | 8,887 | 9,157 | 15,876 | 16,257 |

| Depreciation* | 9,782 | 10,843 | 11,159 | 12,005 | 10,841 |

| R&D Expenses | 3,932 | 4,377 | 4,498 | 4,602 | 4,653 |

| Number of Employees at End of Periods | 8,958 | 9,177 | 9,494 | 11,754 | 11,738 |

| Turnover Ratio | 0.58 | 0.59 | 0.61 | 0.62 | 0.67 |

| Inventory Turnover Period (Months) | 1.7 | 1.9 | 1.8 | 2.0 | 1.6 |

| Net Worth Ratio | 63.9% | 65.3% | 66.3% | 60.7% | 60.0% |

*Capital Expenditure and Depreciation figures represent only those for property, and equipment

The figures for 16/3 do not include the results by THK RHYTHM AUTOMOTIVE.

The figures for 16/3 do not include the results by THK RHYTHM AUTOMOTIVE.