Major Financial Data

*The THK Group decided to adopt IFRS beginning with the 2019 fiscal year.

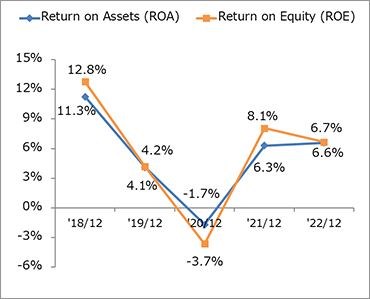

ROA, ROE

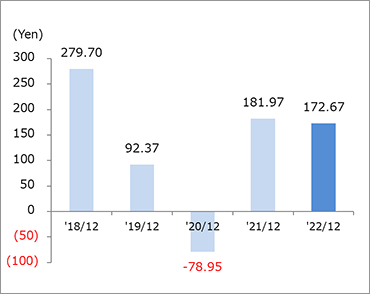

Earnings per Share

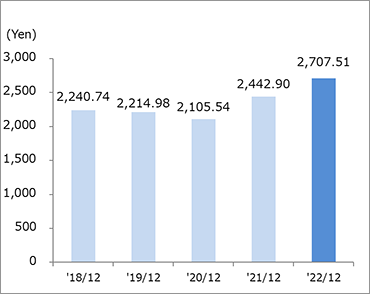

Book-value per Share

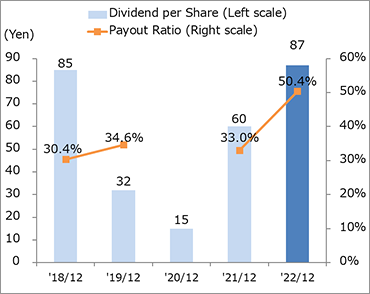

Dividend per Share, Payout Ratio

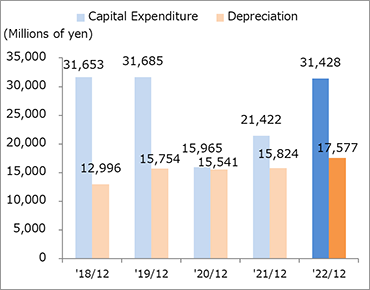

Capital Expenditure, Depreciation

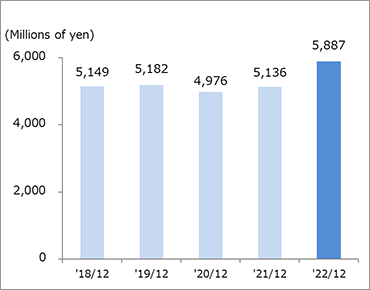

R&D Expenses

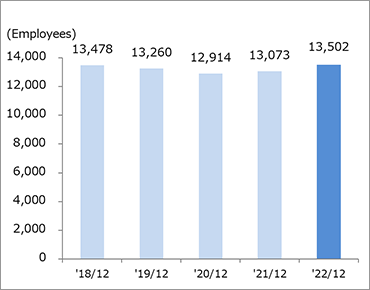

Number of Employees at End of Periods

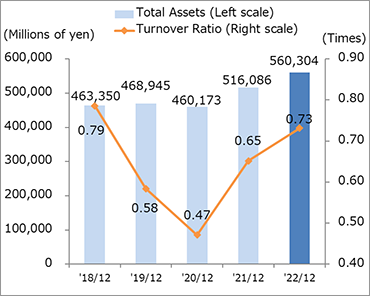

Total Assets, Turnover Ratio

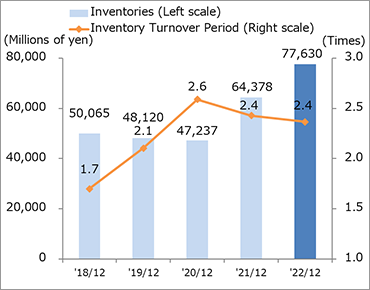

Inventory, Inventory Turnover Period (Months)

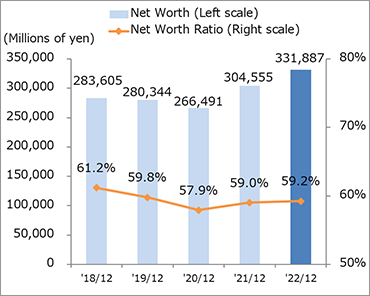

Net Worth Ratio

Millions of yen,Yen,Employees

| '18/12 | '19/12 (IFRS) |

'20/12 (IFRS) |

'21/12 (IFRS) |

'22/12 (IFRS) |

|

|---|---|---|---|---|---|

| Return on Assets (ROA) | 11.3% | 4.1% | △ 1.7% | 6.3% | 6.6% |

| Return on Equity (ROE) | 12.8% | 4.2% | △ 3.7% | 8.1% | 6.7% |

| Earnings per Share | 279.70 | 92.37 | △ 78.95 | 181.97 | 172.67 |

| Book-value per Share | 2,240.74 | 2,214.98 | 2,105.54 | 2,442.90 | 2,707.51 |

| Dividend per Share | 85 | 32 | 15 | 60 | 87 |

| Payout Ratio | 30.4% | 34.6% | - | 33.0% | 50.4% |

| Capital Expenditure | 31,653 | 31,685 | 15,965 | 21,422 | 31,428 |

| Depreciation | 12,996 | 15,754 | 15,541 | 15,824 | 17,577 |

| R&D Expenses | 5,149 | 5,182 | 4,976 | 5,136 | 5,887 |

| Number of Employees at End of Periods | 13,478 | 13,260 | 12,914 | 13,073 | 13,502 |

| Turnover Ratio | 0.79 | 0.58 | 0.47 | 0.65 | 0.73 |

| Inventory Turnover Period (Months) | 1.7 | 2.1 | 2.6 | 2.4 | 2.4 |

| Net Worth Ratio | 61.2% | 59.8% | 57.9% | 59.0% | 59.2% |